A Case Study With Fonolo, An Industry Leader In Managing Customer Volume

Add bookmark

A state of the union and a birth of a trend

A perennial top priority for contact centers, managing customer volume has gained particular urgency amid COVID-19. And surprise, managing fluctuating call volume and unpredictable consumer behavior trends during a never-ending socioeconomic health crisis can be as complicated as it sounds. But as you’ll see in this case study, it doesn’t have to be a laborious cycle of figuring out complicated variables, data sets, and consumer trends that look like a foreign language. If you have the right technologies for tackling difficult tasks, such as managing call volume, business continuity in the contact center seems to plan itself.

Customers are demanding more from businesses, despite businesses’ financial struggles and rushed digital transformation investments. In other words, today’s customers have no sympathy for brands that deliver inferior experiences. They are not going to spend their (decreasing) salaries with companies that do not put ample resources into the customer experience.

It should go without saying, but consumers are still (and will be until a vaccine is developed), very wary of exposure to the virus. As a result, they want to get more tasks completed digitally. While this had always been the case with digitally competent millennials and Gen Z employees and consumers, COVID-19 has forced Gen X, who are even more concerned about virus exposure, onboard.

You don’t have to bury your head in Fox, CNN, Bloomberg, or the WSJ to know that many businesses that haven’t adjusted smoothly during the crisis, across various industries such as the contact center, have shut down permanently.

As Shep Hyken, WSJ and NYT bestselling author, CCW advisory board member, and #1 customer service and customer experience influencer told me a few weeks ago:

It’s all been about what you can do now that we are in the crisis. With “light at the end of the tunnel,” what are companies doing to prepare to get back to normal? How are they going to manage their teams to come back? What are they doing to get their customers ready to return? I think we need to start focusing on the ‘coming back strategy.’

Unfortunately, for many, there was no “light at the end of the tunnel” or heroic success story of overcoming adversity. The reality is many are not doing okay. Conversely, for many, it’s not too late to think about the “coming back strategy.”

To gain new perspectives about the impact of, specifically, customer call volume and B2C contact center trends and do our part in preventing contact centers from making the same mistakes, CCW Digital has recently been in touch with a number of solution providers, such as Fonolo, a contact center solution that seems to be doing a little better than just “okay.”

Dictating the market place

As Fonolo’s Founder and CEO Shai Berger recently told me,

As Fonolo’s Founder and CEO Shai Berger recently told me,

Some of North America’s biggest brands were totally unprepared for the surge in call volume that occurred as the pandemic spread. Many customers were frustrated by impossibly long hold times and left helpless without another way to resolve their issue.

The economic meltdown as a result of the coronavirus requires businesses to do even more with even less. Customer service is no exception to the new reality.

And he’s right. In fact, customer service is more than just “not an exception,” it’s the epitome of “doing more with less,” – especially as operating budgets continue to dwindle and economies at scale suffer. Take a look at some of the stats we highlighted in a recent CCW Digital webinar:

-3.1M Service Agents Worldwide

-Contact Volume +1000%

-Agent Capacity Dropped -20%

-Call Duration +62%

-70% Slower Response Times

-Wait Times +27 Minutes

-Satisfaction -28%

These stats are extremely problematic trends in customer service. However, the only constant is change. And what changes you make as a result of these trends are more important than the numbers themselves. It starts with identifying these pain points so that we can improve the experience consumers are receiving from our customer service departments.

Read More: Special Report Series: State of the Voice Channel

With wait times, call duration and volume increasing at alarming rates - and customer satisfaction scores decreasing at unprecedented ones, many agile, customer-centric businesses are re-defining their communication channels and beginning to make sense of new consumer behavior trends. And in the customer service industry, this might not be a terrible thing from a long-term, macro approach.

Fonolo’s call-back software is the perfect example of the positive tools that can be leveragedduring a pandemic, for the sake of our business continuity planning and customer retention rates. They are a long-term solution to the immediate problems highlighted above.

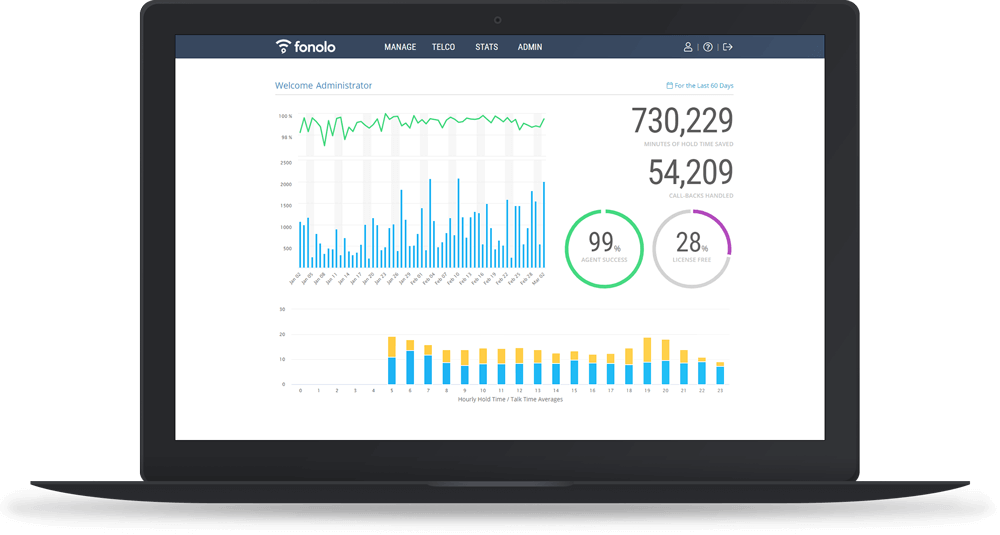

After all, no consumer spending their money on a brand enjoys being put on hold or transferred between agents as a team of customer service agents desperately attempts to resolve a problem, retain a customer, and increase customer-lifetime-value (CLV). Thanks to its consumer-oriented, AI driven software, Fonolo iscurrently one of the leading call-back and virtual hold technologies available to contact centers. The company and its solution have played a pivotal role in helping clients manage call volume and customer inquiries - amid both long-term industry transformation and the impact of the recent pandemic.

Success Stories of Fonolo’s call back and virtual hold technology

Fonolo’s highly secure and flexible solutions allow companies to offer their customers call-backs anywhere through an omnichannel approach: on their phone channels, website, mobile apps, or through any of their existing platforms. Omnichannel trends in customer service and marketing are exponentially emerging for a reason. Why? Customers are using more channels as a means of communication throughout their day-to-day activities. Why should how they communicate with businesses be any different?

In a saturated market of contact center solution providers, Fonolo’s rapid deployment can help companies smooth call volume in a matter of days — without any changes to their current software --making Fonolo a competitively channel-agnostic approach that helps clients see a clear ROI, as you’ll see shortly.

The ability to rapidly deploy alongside any existing call center platform, and its focus on providing personalized service to partners has set Fonolo apart in a drastically changing marketplace.

So what do Fonolo’s clients look like?

- Charles Schwab — providing financial services to over 11 million customers.

- The General Insurance — helping one of North America’s oldest insurers maintain its excellent customer service reputation for over 170,000 callers a month.

- Kohler - enhancing support for the millions of households and businesses containing Kohler plumbing and fixtures

- Nutrisystem — helping thousands get the support they need to get healthier.

Typically when a company approaches Fonolo, they’re struggling to handle high call volume and are suffering from the impact that has on customer satisfaction and, of course, profitability.

As consumer expectations evolve, companies must adapt and upgrade their technology to meet them. Consumers today are too busy to be kept waiting on hold. So, it’s no surprise that companies that replace hold time with a call-back have drastically improved their customer satisfaction rates - Shai Berger, Founder and CEO.

Installing Fonolo call-backs is guaranteed to reduce call abandonment rate — by as much as 60% — and improve customer satisfaction.

1) Smoothing call spikes and reducing overflow costs

When Stanford Federal Credit Union approached Fonolo, it was concerned about the impact itsr contact center was having on the customer experience.

Due to a shortage of skilled agents, Stanford Federal Credit Unit was experiencing long hold times, with many calls being sent to a back-up call center in an attempt to maintain service levels.

Stanford implemented Fonolo’s technology to manage the call volume and empower customers with the choice to receive a call-back instead of waiting.

As a result, its abandonment rate dropped by 50%, and the company saved over $60,000 by eliminating the need to send calls to a business process outsourcer (BPO).

2) Increasing profitability by adding another sales channel

1st United Services Credit Union was highly concerned that it was not attracting new members young enough. It recognized the need to provide more options for contacting the organization besides just traditional channels such as phone and email.

By integrating Fonolo’s solution into its web and mobile platforms, 1st USCU reduced the friction for customers. A positive ROI was reached in 60 days, and in the first year alone, over $10 million in new loans were booked through Fonolo-powered call-backs.

3) Fonolo doesn’t fail under pressure

Credit Union of Colorado started using Cisco Finesse call-backs due to cost after being a long-time customer. But during its digital banking conversion, Cisco couldn’t handle the increased capacity and repeatedly failed, a clear and problematic trend many are facing.

Within a week, CUofCO had returned to Fonolo and was once again seeing reduced abandonment rates and improved customer satisfaction.

As Laura Reinhold, MSCC Manager, CUofCO stated:

Leadership and the members are happy that we once again have Fonolo as our call-back solution. We’re excited to have real-time call data again, and we’re grateful to have a business partner we can trust.

No one’s safe from the behavioral economic consequences brought upon by the coronavirus. But adopting cost-effective CX strategies will give you the best chance at being on the favorable side of financial Darwinism.

With over 150,000 global members, join the largest research hub for customer contact and customer experience professionals by subscribing here. Through our complementary offerings, you’ll have access to the latest research, news, blogs, podcasts, webinars, whitepapers, events, training, and technology insights in customer experience.

For media coverage, lead gen, and digital marketing inquiries, contact me at matt.wujciak@customermanagementpractice.com.

And remember, managing your relationships with your customers is like managing a relationship with your significant other. Your life is going to be easier if you don’t make them wait. So why not call them back?

Website: fonolo.com

Linkedin: Fonolo

Twitter: @fonolo